Buying your first home is exciting, but it can also feel like you’re stepping into a whole new world of real estate lingo and financial decisions. That’s why having first-time home buyer mortgage tips at your fingertips is crucial. Since most first-time buyers rely on financing, understanding how mortgages work is key to making smart decisions.

Buying your first home is exciting, but it can also feel like you’re stepping into a whole new world of real estate lingo and financial decisions. That’s why having first-time home buyer mortgage tips at your fingertips is crucial. Since most first-time buyers rely on financing, understanding how mortgages work is key to making smart decisions.

The good news? With the right guidance and a bit of homework, you can avoid common pitfalls and set yourself up for success. Let’s dive into some essential mortgage tips to help you navigate the process with confidence.

“I’m passionate about helping first-time home buyers navigate one of the biggest investments of their lives. With years of experience, I simplify the process, break down the financial details, and add a bit of humor along the way. From budgeting to finding the right loan, my goal is to empower buyers to make smart, confident decisions for a happy future.” -Kevin Wood (Realtor, Author, SRES, SFR, IMSD)

Understand Your Financial Picture

Before you start house hunting, it’s crucial to get a clear understanding of your financial standing. Just because a lender says you can afford a higher mortgage payment doesn’t mean you should stretch your budget to the max.

Consider these factors:

Your current rent vs. potential mortgage payment

Ongoing expenses like vacations, hobbies, and future purchases

Homeownership costs such as maintenance, lawn care, and repairs

Take the time to review your monthly budget to ensure you’re comfortable with your new financial commitments.

Down Payment: Just the Tip of the Iceberg

Sure, you’ve saved up for the down payment, but don’t forget about other upfront costs. When you make an offer on a home, you’ll need to provide earnest money, typically around 5% of the purchase price. This shows the seller you’re serious.

Beyond that, there are closing costs to consider, which include:

Appraisal fees

Title insurance

Lender fees

Home inspections

And let’s not forget the moving expenses, utility transfers, and the inevitable “we just moved in” takeout nights.

Boost Your Credit Score

Your credit score has a huge impact on your mortgage rate. A better score can save you thousands over the life of your loan. Here’s how to give it a boost:

Pay all your bills on time

Pay down credit card balances

Keep older accounts open

Avoid taking on new debt before buying

Even a small improvement can mean big savings. For instance, a 1% lower interest rate could save you over $50,000 on a 30-year loan.

Use Credit Monitoring Tools

Services like Credit Karma and Credit Sesame can help you stay on top of your credit health. They provide:

Free credit score monitoring

Alerts for any changes

Tips to improve your score

While they use the Vantage Score model (not the same as FICO used by lenders), they still provide valuable insight into your financial standing.

Factor in More Than Just the Mortgage

Owning a home means you’re responsible for everything—from fixing that leaky faucet to replacing the roof down the road. Plan to set aside 10-15% of your mortgage payment for maintenance and unexpected repairs.

Additionally, you’ll need to budget for:

Utilities (electricity, water, gas, internet)

Property taxes

Homeowner’s insurance

If you’re moving from a rental where utilities were included, brace yourself for some new monthly expenses.

Get Preapproved Before Shopping

Before you fall in love with that dream home, get preapproved for a mortgage. A preapproval does two things:

Helps you understand how much home you can afford.

Shows sellers you’re a serious buyer, giving you a competitive edge.

Most real estate agents won’t show homes to buyers who aren’t preapproved, so make this step a priority.

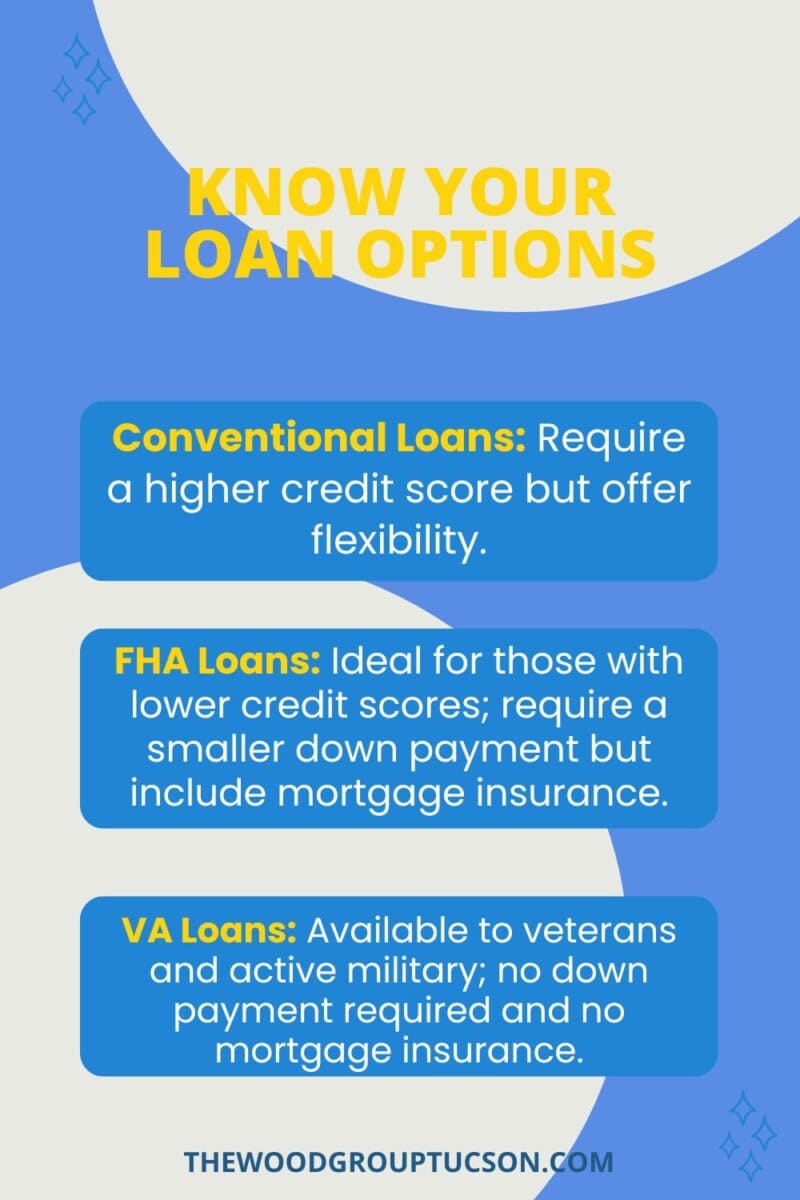

Know Your Loan Options

There are several types of mortgages to consider:

There are several types of mortgages to consider:

Conventional Loans: Require a higher credit score but offer flexibility.

FHA Loans: Ideal for those with lower credit scores; require a smaller down payment but include mortgage insurance.

VA Loans: Available to veterans and active military; no down payment required and no mortgage insurance.

Your mortgage lender should walk you through the pros and cons of each option to find the best fit for your situation.

Understand Closing Costs

Closing costs typically range from 3% to 6% of the loan amount and include fees such as:

Loan origination

Appraisal and inspection

Title searches

Attorney fees

Knowing these costs upfront can prevent any last-minute surprises at the closing table.

Choose Your Location Wisely

Your home’s location affects more than just your daily commute. Consider factors like:

Proximity to work, school, and amenities

Neighborhood vibe and demographics

Future resale potential

Remember, a longer commute might look fine on paper, but in reality, it can eat away at your time and patience.

Think Long-Term Resale Value

Even if you plan to stay in your new home for years, life happens. Consider factors that impact future resale, such as:

Avoiding the most expensive home in the neighborhood

Opting for a property with broad appeal

Ensuring the home meets common buyer preferences

Read the HOA Agreement Carefully

If your new neighborhood has a homeowners association (HOA), take time to read the agreement thoroughly. Some HOAs have strict rules about:

Exterior paint colors

Landscaping requirements

Parking restrictions

Make sure you’re comfortable with the guidelines before signing on the dotted line.

Don't Let Emotions Drive Negotiations

It’s easy to get attached to a home, but keep your emotions in check during negotiations. Stay objective and consider:

Asking for repairs or concessions

Comparing the home to similar properties

Walking away if the deal isn’t right

Differentiate Needs vs. Wants

Be honest with yourself about what you truly need in a home versus what would be nice to have. Prioritize essentials like:

Number of bedrooms/bathrooms

Location and commute time

Safety and schools

That gourmet kitchen? It can wait.

Final Thoughts

Buying your first home is a huge milestone, and preparation is key to making it a positive experience. By understanding the mortgage process, planning for hidden costs, and working with the right professionals, you’ll be well on your way to homeownership without unnecessary stress.

ABOUT THE AUTHOR

I’m Kevin Wood, a trusted professional in residential real estate who has served southern Arizona and the surrounding areas since 2005. My knowledge and experience covers a wide range of topics including general real estate, mortgages, financing, seniors, moving, and home improvement.

I’m Kevin Wood, a trusted professional in residential real estate who has served southern Arizona and the surrounding areas since 2005. My knowledge and experience covers a wide range of topics including general real estate, mortgages, financing, seniors, moving, and home improvement.

I can be reached at Kevin@wood.staging-1.site or by phone at 520-260-3123. For the past 19+ years, I’ve helped over 600 families move in and out of southern Arizona and constantly rank among the top 10% of realtors nationwide for performance and client satisfaction.

Are you planning a move? I’m passionate about real estate and enjoy sharing my knowledge and skills in marketing.

I serve people with real estate needs in the following areas of southern Arizona: Tucson, Vail, Corona de Tucson, Sahuarita, Green Valley, Oro Valley, Marana, Picture Rocks, Catalina, Saddlebrooke, Benson, Tanque Verde, Three Points, and Red Rock.